Commercial & Multifamily Real Estate Investment and Development Resources

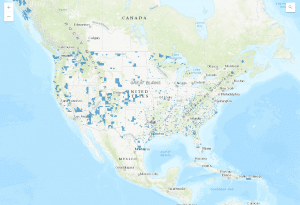

Interactive Opportunity Zone Map

Use our Interactive Opportunity Zone Map to evaluate opportunities and perform site selection in Qualified Opportunity Zones. LATEST UPDATES: We now have a separate map that shows the major MSAs and the Qualified Opportunity Zones located therein Added direct links…

Read MoreQualified Opportunity Zone Resource Center for Real Estate Developers

Welcome to our Real Estate Developer Resource Center for investing and developing inside Qualified Opportunity Zones. Below the map are resources curated for the use of real estate investors and developers including official sources, downloadable documents, other portals/hubs, recent news,…

Read MorePwC & ULI Emerging Trends 2019 – Real Estate Research Roundup

PwC and the Urban Land Institute (ULI) annually produce one of the most comprehensive outlook reports in the real estate industry. Because of their long-running track record in producing this report, as well as their unprecedented access to C-level executives in the real estate industry, it is an absolute must-read for all real estate market participants

Read MoreWhy Sellers Should Run Due Diligence, Too

While still relatively rare, sell-side real estate due diligence can reduce the property’s time on the market, lower the risk of re-trades and improve the return, advise two consultants with CREModels.

Read MoreCREModels Unveils New Tech Tools for Commercial Real Estate

Flagship software platform, The CRE Suite, gets a major update, empowering commercial and multifamily real estate investment and development teams to close more deals, company says.

Read MoreDue Diligence is Critical for West Coast Real Estate Investors

Due diligence is of the utmost importance in all real estate transactions. However, it is particularly crucial in the West where taxes, resources and weather can play a role in a landlord’s ability to increase (or decrease) their ROI.

Read MoreA New Formula for Retail Rents

As shopper behavior continues to evolve, shopping center owners are exploring new ways of calculating rents that are less dependent on sales.

Read MoreWhy Retail Landlords Lose Tons Of Money To Faulty Expense Calculations

CAM recs article, originally appeared on Forbes.com by Mike Harris Retail real estate has an underappreciated problem: Year after year, incorrect or incomplete tenant expense reconciliations cost landlords an enormous amount of money. Erroneous common area maintenance and other reconciliations…

Read MoreShowroom-Like Stores Could Overthrow the Basis for Retail Rents

Traffic and customer data could eventually trump traditional measures such as sales per square foot

Read More